Happy 4th of July weekend!

Last weekend, in my Market Forecast, I said,

"For the new week, the markets look to open on the downside. SPX's initial support is at 2080. Below 2080, there is support between 2060-2040."

The trading went along with the forecast. On Monday, stocks fell heavily. By noon, SPX was down below 2080. The selling didn't stop until the market close on Monday, where SPX closed just below 2060. On Tuesday, buyers came back. On Thursday morning, SPX re-tested 2080, but, closed below that mark before the long weekend for 4th of July.

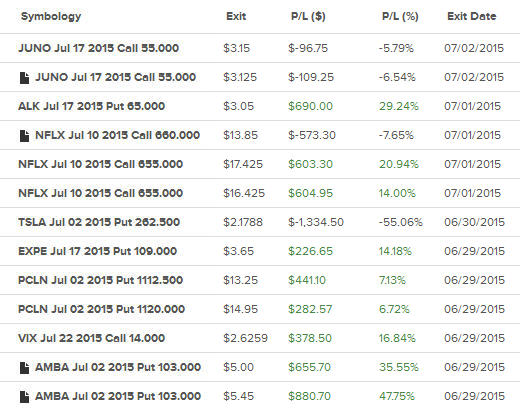

We traded very well last week, with my Ecstatic Plays portfolio still at near the new all-time high. We kept mostly cash and traded less, but, on both sides. Here are the closed trades for the week:

As a new week starts, tonight, the big news is once again "Greece"! On Sunday, the Greek voters voted "No" in the bailout referendum, which rejected further austerity in the bailout proposal put forth by the creditors. At the time of composing this article, Asian markets were down, with Hong Kong down over 3% and Japan down about 2.5$. Shanghai is "up" about 2%, as the Chinese government released support measures to try to prevent further market slide.

For the week, the Dow was down 216.57 points; SPX fell 24.71 points; Nasdaq fell 71.3 points. Oil (WTI) fell to about $55/barrel, while gold traded slightly lower, but, stayed above $1160/ounce. Here are where the US markets stood after Friday's close:

SPX

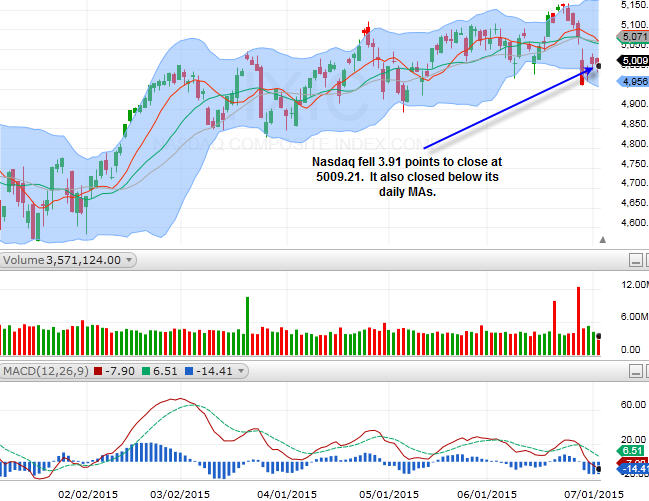

Nasadq

Both SPX and Nasdaq closed below their respective daily MAs, and the MAs turned down. For the new week, the markets are looking to pull back further. It does look like the problems in Greece are going to drag on longer than what the EU had hoped. Since SPX closed below 2080, SPX's immediate support now is between 2060-2040. Below that, the next support is at around 2025.

In light of this type of global news, we will, of course, keep our attention on the financials. Besides those, tech stocks have been very strong. On the flip side of that coin, they could have more to fall. We'll need to see if they can hold up.

Market Watch

FAS (financial)

FDN (internet)

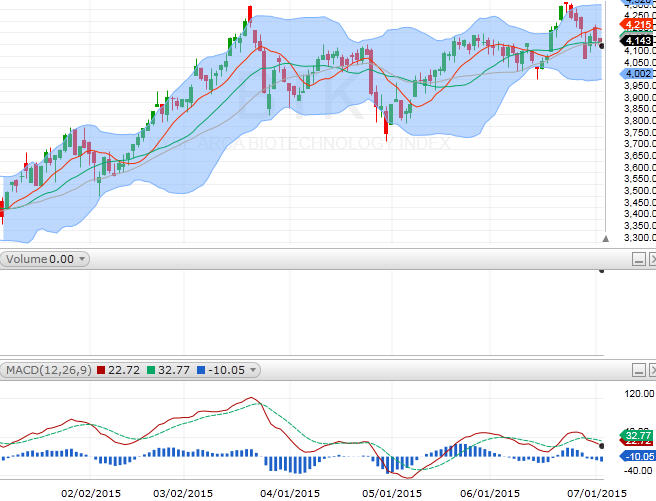

BTK (biotech)

IGV (software)

As I'm finishing this article, China has now turned red. Hong Kong is down almost 5%. Japan is holding at 2.25%.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member