THE WEEKLY TOP 10

Table of Contents:

1) There was nothing fundamental about last week’s (somewhat expected) bounce.

2) The Fed cares more about high inflation than a weak economy.

3) When markets rise in an extreme manner, they always (eventually) fall in an extreme manner.

4) The MACD charts say this rally could last for a few weeks.

5) The energy sector is getting overbought. We’re don’t want to chase it at these levels.

6) We’re headed for a recession…and the Fed knows it. (So do most Wall Street economists.)

7) Nice technical bounce in the high yield market, but it’s already extended by one measure.

8) Can the housing stocks fool everybody and rally from current levels?

9) What if we have widespread food shortages. (Think social unrest.)

10) Summary of our current stance.

1) Last weekend and early last week, we highlighted that a short-term rally was probable in the stock market…and that is exactly what took place last week. However, make no mistake about it, the rally was merely a technical one. It could last for a few more days…and even a few weeks. That said, nothing has really changed when it comes to the reasons why the stock market and other risk assets have been falling this year. Therefore, we believe that we’ll see lower-lows in the months ahead.

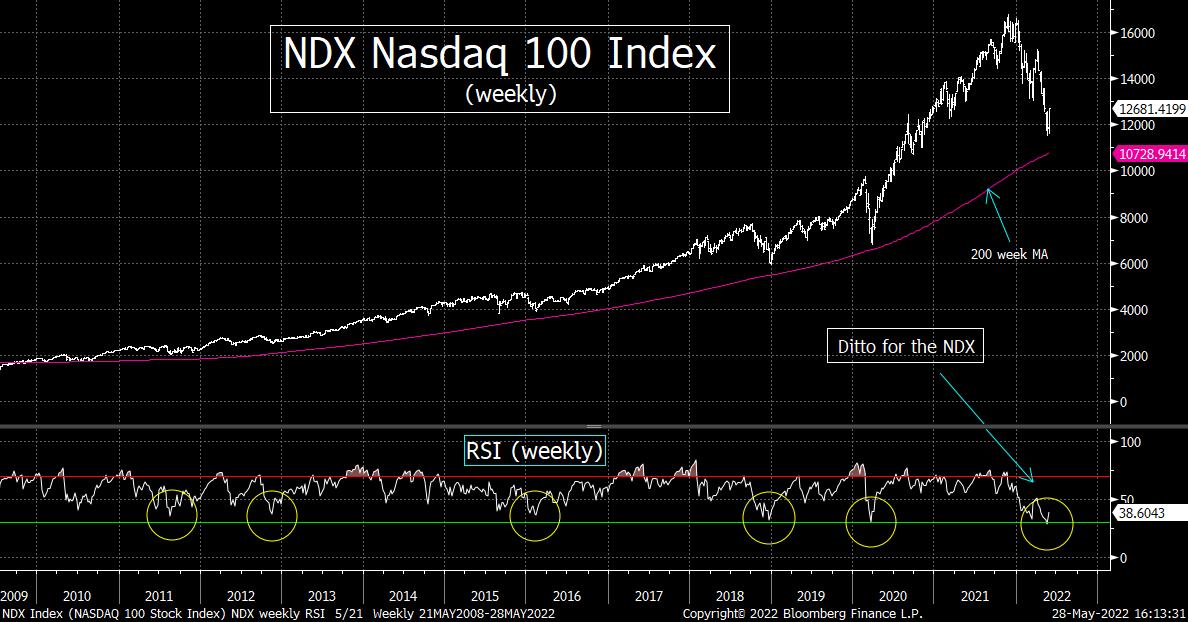

After disappointing investors when it did not see a “buy the news” reaction to the Fed’s 50 basis point rate hike 2.5 weeks ago, the stock market finally bounced nicely last week. It was something we said was likely to happen…because several of the weekly charts on the S&P 500 Index and the NDX Nasdaq 100 had become quite oversold. We also pointed out the extreme levels of bearish sentiment…and the fact that several of the key stock groups (and some other asset classes) had become very oversold as well.

To be more specific, we showed how the SPX and NDX had become quite oversold on their weekly Relative Strength Index (RSI) charts…and extremely oversold on the weekly Bollinger Bands charts. We showed the same thing for the charts on the technology, retail, consumer discretionary ETFS…and for other markets like the high yield market and even the investment grade bond ETF. So, it was no surprise to us when the S&P 500 bounced 6.5%, the NDX bounced 7.7%, the XRT jumped 10%, the XLY advanced 9.5% and the HYG rose almost 5%.

Many pundits tried to highlight several fundamental reasons for the bounce. The most common one given was the thought that the Fed will become less aggressive in their tightening policy once we get past the next two FOMC meetings. We’re sorry, but disagree. This is what Wall Street always does in a bear market rally. The market becomes oversold on a very short-term basis. THEN, it bounces…for no other reason than due to the fact that the market had become oversold…BUT Wall Street ALWASYS comes up with some fundamental reason. The fundamental reason always has enough theoretical legitimacy to give investors hope that the rally is for real. However, it reality, the fundamental reasons had very, very little to do with the bounce…and thus the bounce fails after a couple of weeks. (Sometimes, after just several days.)

We strongly believe that this is what took place. First of all, we showed last weekend, just how oversold the markets had become. Second, there was little question that sentiment had become extremely bearish by last weekend. However, we DO understand why people would think that a change in the expectations about the Fed’s future policy moves had an impact on the markets last week. But just because we understand why people might think that way…does not mean we agree with them!

The main reason why we understand why people would think that a softening in the Fed’s futures plans later this summer/early-fall is because we had a week where the “Fed minutes” were released last week…AND where the bond yields came down and the Fed Funds Futures shifted to a less aggressive stance. HOWEVER, all of last week’s drop in the 10yr yield came BEFORE the “minutes” were released. In other words, it took place when the stock market was still falling…and thus the decline in yields was due to a “flight to safety” move, NOT a change in Fed expectations.

This makes further sense…given that the 10yr yield has been falling since early May…as the stock market has been hit hard. This shows that the decline in yields is much more likely to have been a flight to safety trade (given that the inflation numbers have remained extremely high). As we have highlighted several times as this bear market has formed, during bear markets, higher yields initially cause the stock market to drop. THEN, as the stock decline becomes severe, the situation shifts. Instead of the stock market reacting to the bond market, the bond market starts reacting to the severe drop in the stock market…..

THIS is what we’ve seen in recent weeks. Sure, there has been some weaker economic numbers, but since the main problems facing inflation has to do with supply issues, it’s hard to think that this weaker data has caused the lower long-term rates. The inflation numbers have still been strong. Energy and food prices are still at or near their 2022 (multi-year highs). Given that the Fed is fighting inflation…and not a uber-strong economy…it’s hard to argue that a few somewhat weaker economic data points have caused this drop in rates. Instead, it has been the “flight to safety” trade. Let’s face it, those 10yr yields actually STOPPED going down after the Fed minutes were released last week! (We’d also note that the yield on the 2yr note…whose big decline has gotten a lot of attention recently…moved decidedly higher over the past few days of the week last week…after the Fed minutes were released.)

We do admit, however, that the Fed Funds Futures did shift throughout the week. They are now pointing to fewer quarter-point rate highs (after the next two half point hikes) by early 2023. However, that change in the FFF coincided with rally in the stock market. In other words, it’s not like the FFF began to change…and then the stock market began to rally. They moved in tandem, so it could easily be the case that the FFF’s were reacting to the stock market…rather than the stock market reacting to the move in the FFF’s……We know that many of those who have never worked on a trading desk will think we’re out of our minds to think that the FFF’s reacted to the stock market. However, our almost 4 decades of experience on Wall Street tells us that this is much more likely what took place. It’s the way thing evolve during bear markets. Bear market rallies turn everything upside down.

In the next bullet point, we’ll discuss why we believe that the situation has not changed much at all…and thus, why we think the stock market (and many other risk assets) will see lower-lows (decidedly lower-lows) before we experience the ultimate bottom for this decline. However, in this first bullet point, we wanted to show why we believe that last week’s bounce was purely a technical one. Fundamentals had almost nothing to do with it. Therefore, it is very unlikely that will last into Q3 in our opinion. In fact, we’d be quite surprised if it lasted much past the first week or two of June.

2) One of our biggest concerns is that too many people are focused on the economy when they’re trying to determine what the Fed will do in the future. This is a big mistake. The Fed has told us time and again that they are focused on bringing inflation under control. They have also readily admitted that they cannot control the supply issues that are driving much of today’s inflation problem. Therefore, if inflation remains high, the Fed will continue to tighten…EVEN if the economy slows considerably. This is another key reason why we seriously doubt that we have seen the lows for this decline in risk assets.

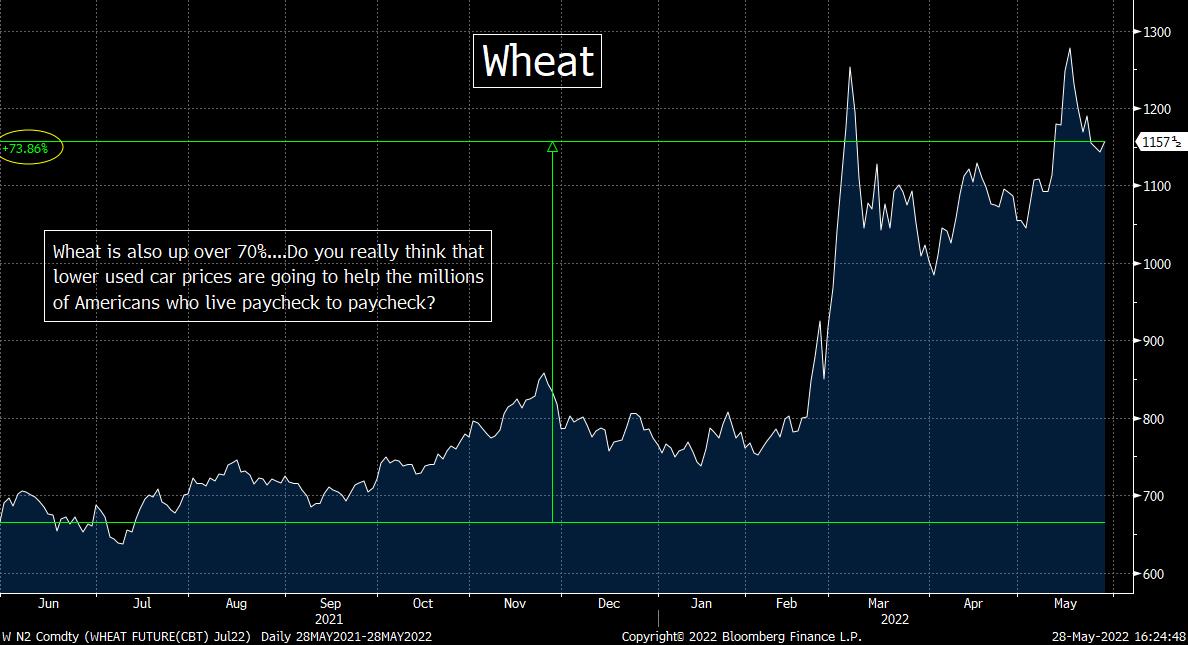

We have been saying ad nauseam that it does not matter if we reach “peak inflation” any time soon. If is stabilizes at a high level…which is quite probable in our minds…they will have to remain quite hawkish for a considerable period of time. Forget about the arguments about whether we’ll have stagflation or not…it’s already here. On the “flation” part of stagflation, who the hell cares if used car prices are coming down??? Inflation for every day Americans is going to remain high for their essentials. So even if the official numbers come down quite a bit, inflation is not going to ease for the 64% of Americans who live paycheck to paycheck. (Besides, those official numbers are still going to stabilize at a very high level.)

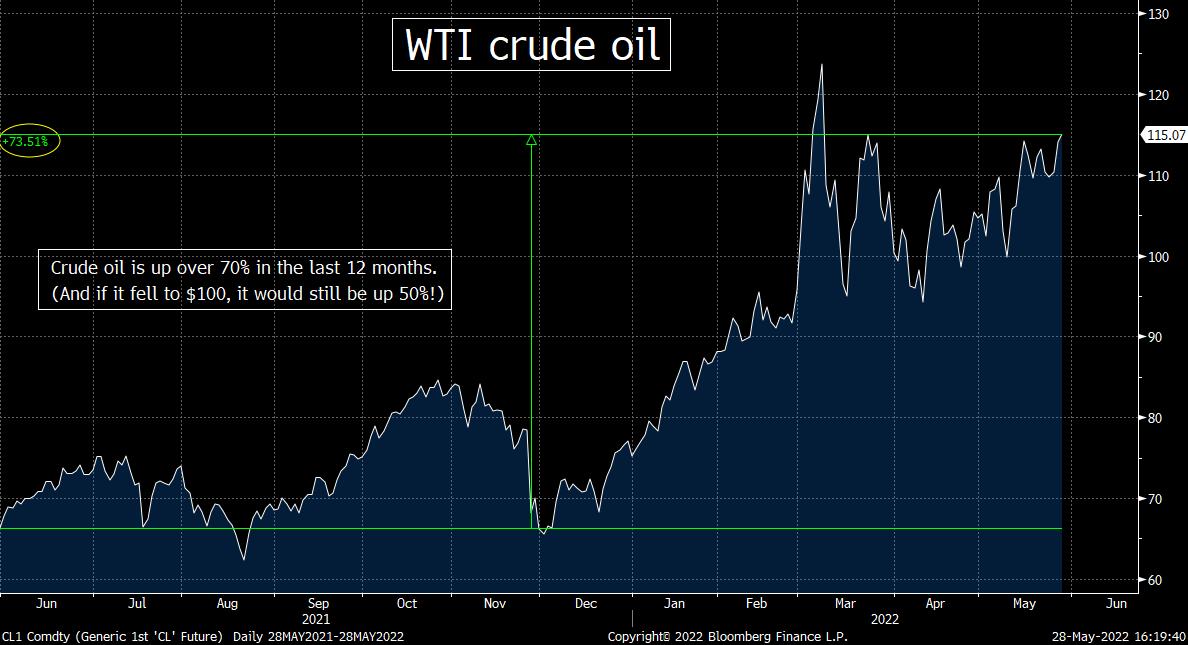

Food and energy prices remain extremely highs. WTI crude oil still stands a whopping 73% above its level from 12 months ago…and natural gas is almost 200% higher!!! As for food, wheat also stands 73% above its year ago level…and corn is 40% higher. Therefore, although it’s nice to hear that used car prices are coming down…and airline ticket prices could fall…and rents are stabilizing…the prices of the key essential products that everybody needs on a daily basis remain extremely elevated…and show no signs of easing.

On the “stag” part of stagflation, we’re finally seeing the impact of these high prices for staples on the consumer. Consumer confidence continues to decline (as does their expectations for inflation)…and some retailers are indicating that the higher prices on food & energy is indeed having an impact on their spending habits. Yes, there are SOME retailers who have not been affected yet, but they tend to be the ones who are not catering to the large portion of America that lives paycheck to paycheck.

We’d also want to make a quick comment about those who are trying to say that the consumer is not pulling-in their horns, they’re merely “re-allocating” their spending. This is one of the most ridiculous narratives we have ever heard. (Well, at least the most ridiculous one to ever gain any traction.) According to this narrative, consumers are not weakening, they’re merely re-allocating” their spending. (It reminds us about when we read how army changed the term “replacements” in WWI…to “reinforcements” in WWII. They also changed the name of the “War Department” after WWII…to the “Defense Department.”)…..When it comes to most Americans, “re-allocating” their spending TOWARDS the essentials…and moving a lot more of their spending AWAY from discretionary items…IS a sign of a weakening consumer!!!!!

Anyway, due to the lingering impact of the pandemic…and the renewed shut-downs in China…and the war of attrition in Ukraine…we believe that inflation is going to remain a problem for an extended period of time. Yes, the Fed’s tightening policy will create the kind of demand destruction that will help inflation decline somewhat. However, these other supply-related issues we highlighted above (especially the war of attrition) are not going to go away soon. (This is why supply-driven inflation is so tough on the economy and on risk assets. They tend to be fixed by political means…and that almost always takes a very, very long time to fix.) Thus, there is very little the Fed can do to ease the problem.....In order for this bout of inflation to decline in a substantial manner, we’re going to need to see the sanctions removed from Russia, a reopening of China, and a major improvement in the supply chain problems we’re facing right now. (BTW, if China invades Taiwan…which would send chip prices through the roof…the 1970s inflation problem would pale in comparison.)

Maybe all of these geopolitical issues can be solved in the coming months, but none of them will be solved by the Federal Reserve. Of course, if the markets (especially one of the important fixed income markets) starts to seize up, we WOULD expect the Fed to be forced to “pivot” much earlier than we’re thinking right now. The problem with that kind of development is that it will simply cause another bubble to form…which would not be good at all for the long-term prospect of the U.S. and global economy…….HOWEVER, no matter what it might mean for the longer-term, the situation we would face in the lead-up to the “seizing up” in one of the markets will involve a significant further decline in risk asset prices (including stocks) BEFORE the Fed would pivot.Therefore, thinking that the Fed will pivot sooner than most people believe at this point is NOT a reason to be bullish on stocks right now. In fact, it is a reason to be BEARISH on the intermediate-term potential for the stock market!

Either way, until we see a big change in policy…which we DO NOT expect to take place just because the economy weakens in a considerable manner…the line of least resistance for risk assets over the intermediate/long-term will be lower…..Remember, it took an important change in policy to stop the last four significant declines in risk assets. In 2009, it took a change in the “mark-to-market” rules…in 2011, it took the bailout of Greece…in 2018, it took the pivot by the Fed (when the high yield market froze up)…and in 2020, it took the massive QE programs from the global central banks (at the depths of the pandemic-led shutdown of the global economy)……..The same should be true this time around. Until we see an important change in policy, a lasting bottom for risk asset prices will be fleeting…and a mere recession will not be enough for them to shift that policy.

3) One of our biggest concerns right now is still that too many people do not realize how important the Fed’s massive stimulus programs have had on the markets and the economy over the last dozen years…and especially the last 2 years. Given that most people don’t realize how much upside impact the Fed has had on economic growth and the markets’ rallies, they don’t realize how much their shift in policy will cause a lot more weakness than usual (in both the economy & the markets).

We have been saying for a year now that the Fed had kept their massive/emergency level stimulus program in place far too long after the economic emergency had passed. We were in the minority in saying this last spring and summer, but we were certainly not the only ones that were warning about this issue. In other words, we were blaming the Fed for pushing asset prices too high…and saying that once they finally (and INEVITABLY) ended their stimulus programs…the markets would decline in a significant way…and the economy would slowdown in a similar fashion.

However, some of the pundits who have agreed with us throughout the last year…are blaming the Fed TOO MUCH. They are saying that if the Fed had changed their policy earlier…when the economy was growing (instead of slowing, like it is now)…the impact would have been much less severe. They say that if the Fed had acted earlier, they could have achieved a “soft landing.”

We disagree. Don’t get us wrong, the decline in the markets WILL be worse due to the fact that the Fed shifted their policy so late…and the slowdown in growth WILL be greater. However, that’s only because the Fed’s largess pushed markets and economic growth to higher levels than they ever should have reached that these bigger decline will take place! The amount of stimulus was SO massive over the past two years, that it was ALWAYS going to cause a significant decline in the markets once it was removed…and it was ALWAYS going to cause a material slowdown in growth. In other words, the Fed is not suddenly tightening within a slowing economy, their tightening policy CAUSED the economy to slow down…and thus if they had tightened their policy a year ago, it would have caused the slowdown in growth much earlier.

Yes, we do understand the argument that says that it was the Fed that caused the big rise in inflation. In fact, we do agree that they exacerbated the problem. However, the supply chain problems resulted from the pandemic played a much larger role in our opinion. More importantly, the war of attrition in Russia has created an even bigger multiplier effect on the inflation problem…..If most of the inflation problem dealt with the issue of “demand,” we’d feel differently. However, since most of the problem deals with the “supply” issues (which the Fed has NO control over), we believe that argument that the Fed created most of our current inflation problem falls flat.

Again, we DO find fault with the Fed. The decline will take us to a lower level in the market and to a lower level of growth. This will happen because their willingness to keep the liquidity spigots wide open caused investors and businesses to leverage up much more than they would have if they had started tightening last summer. (Tapering IS tightening.) Since the unwinding of leverage causes markets and economies to swing to the other extreme once the leverage needs to be unwound, the markets will fall further and the economy will weaken more than if they had shifted policy earlier.

However, the severe market weakness and the meaningful economic weakness was ALWAYS going to raise its ugly head when the Fed shifted their policy away from the record-breaking level of stimulus they provided to save the global financial system from imploding back in 2020. It was inevitable. You cannot take away extreme levels of stimulus without it having a decidedly negative impact on stock prices (and economic growth)…which never would have reached those levels without that stimulus.

As it is with many pundits when they try to use economic growth at the guide for when the Fed will stop tightening (like we highlighted aboe), too many of them are still trying to measure where this decline in stock prices will end by using economic measures. For instance, some try to use statistics like “the average decline for the market if we have a slowdown, but no recession”…and/or “the average decline in stocks if we DO have a recession.”…….We’re sorry, but these are moot points.

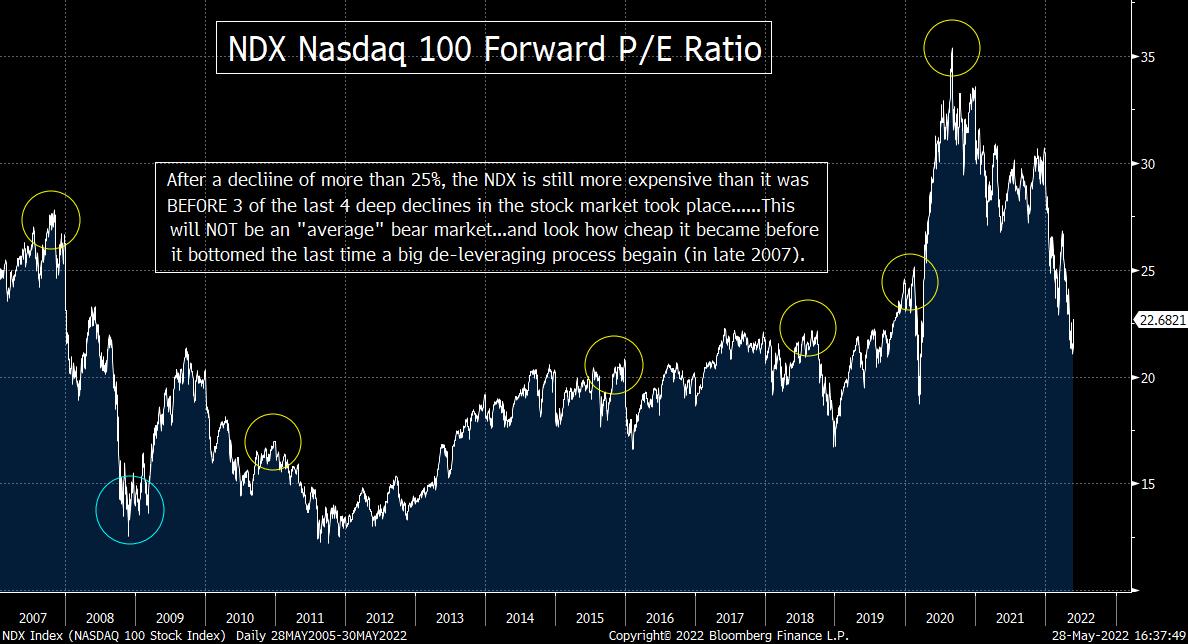

The problem with this thinking is that the stock market was A LOT more expensive at its peak than when the “average” deep correction/bear market begins…..For instance, the forward P/E on the NDX Nasdaq 100 was above 30 at the beginning of this year…vs. 22x at the 2018 highs…20x at the 2015 highs…16x at the 2011 highs…and even 27x at the 2007 highs!!!.......Except for the dotcom bubble (which was obviously even more extreme), we have never seen the kind of valuation levels that we saw at the beginning of the year……The massive level of stimulus pushed that stock market to the kind of extreme that was well above the average we see at most tops. Therefore, we’re going to have to see a much bigger decline than an “average” decline.

Let’s face it, comparing today’s market to an “average” market would be like telling two overweight men who are both six feet tall that if they lost 100 pounds, they’d be fine. Well, what if one of those guys weighed 320 pounds…and the other guy weighed 420 pounds? Only the guy who got down in to the low 200s would move into a healthy weight category. The other one would still be overweight. Therefore, looking for a decline that would fall into anything close to the “average’ category is whistling past the graveyard in our opinion.

What we’re trying to say in this bullet point is that investors have to look at the starting point from which this bear market begun. They ALSO have to focus on how we got to that starting point. The point (or level) from which this bear market began was one that was extremely expensive…and it became expensive in large part because of artificial stimulus. Now that this artificial stimulus is not only disappearing…but reversing…the decline is going to have to be an outsized one. This was ALWAYS going to be the case. Some people don’t realize this because they don’t want to admit to themselves that a large part of the big gains of the past 2 years (and the past decade) have been artificially induced. Thus, they cannot come to grips with how far things will have to fall…to move the markets and the economy back into sync with one another.

In other words, this process is going to be a much more painful one than anybody would like. However, it is a process that needs to be done. It will make our economy and our markets much healthier…and it will create some great opportunities in the coming months and years. However, we do not live in “average” or “normal” times…and thus we should not be looking for this synchronization process to be an average or normal one…….It was far too euphoric than “average” on the way up, so it’s going to be more painful than “normal” on the way down……..(Sure, the Fed deserves some of the blame, but in order to save the system back in 2020, we were always going to see a BIG boom/bust cycle. It’s just going to be a bit bigger because the Fed waited too long to pull the plug.)

4) Okay, now that we’ve firmly established that we’re still bearish on the intermediate/longer-term prospects for the stock market, we do need to point out that last week’s action is the kind that is frequently followed by more upside follow-through. A lot of people (even some who are very bearish) believe that the S&P 500 could/should reach 4,200 or 4,300 level before it tops out. Others think it go higher…and, of course, some think THE bottom is already in place. One item that supports more upside movement in the major averages is the MACD charts on the S&P 500 and the NDX 100. They are pointing to rallies that will last for several weeks…not just a few days.

The MACD (the “Moving Average Convergence/Divergence”) chart is something that helps us determine whether a short-term change in momentum has taken place. (Positive crosses show a change to some bullish momentum…and vice versa.) Therefore, these signal tend to come a few days after a short-term top or short-term bottom has been put in place. (This is very similar to what “golden crosses” and “death crosses” show on a more intermediate-term basis. Those “crosses” involve the 50 DMA and the 200-DMA…while the MACD charts deal with the 9 and 12-day EMA’s.)

Last week’s bounce in the stock market gave both the S&P 500 and the NDX 100 positive MACD crosses. As you can see from the charts bellow, the last few times this has taken place, it has been followed by multi-week rallies in these indices…and not just “dead cat” bounces. Therefore, if we see any upside follow-through after Tuesday (the last trading day of the month), it could indeed be telling us we’ll see the stock market rise even more before we get another significant pullback. (Even if it heads higher, it won’t come in a straight line, so we shouldn’t be worried about one-day declines…as long as they are not serious moves lower…on big volume and lousy breadth.)

We’d also note that the Russell 2000 small-cap index did not make a lower-low back in the second half of May (like the SPX and NDX did). It made a higher-low…and followed that up with “higher-high” last week. Like the SPX and NDX, the Russell 2000 experienced a positive MACD cross. This could/should be bullish for the small caps IF they can see more upside follow-through.

These developments are not enough for us to think that a further rally from here will morph into a multi-month rally. However, we became bearish again too early back in March. Yes, we called for a very-short-term bounce back then, but it lasted longer than we thought…and it took the stock market higher than we thought it would. These developments from last week mean we could see another multi-week advance. No, it does not guarantee one. In fact, we’re skeptical that it could last more than another week. However, if we’re being honest with ourselves, we have to admit that last week’s technical action is the kind that could take the market higher than we’re thinking right now.

5) One of the best calls we have ever made in our career was turning bullish on the energy sector just before it turned higher in the fall of 2020. Everybody on Wall Street hated the sector, but we started pounding the table on the bullish side of the ledger…several months (and dozens of percentage points) before anybody else did in 2021. HOWEVER, the sector is starting to get very overbought on an intermediate-term basis, so investors need to be careful about chasing it at these levels.

Long-time readers know that we turned bullish on the energy sector in early October of 2020. In fact, most of you are probably tired of us taking a victory lap on this call so often. However, given that we turned bullish several months before anybody else did (which is when a huge part of the move took place)…and given the 220% rally in the XLE energy stock ETF and the 420% gain in the XOP oil and gas E&P ETF since we turned bullish back then…it’s hard not pound our chests ever once in a while.

Speaking of “every once in a while,” we have also stepped back a few times from the group since the fall of 2020. No, we did not turn bearish on it. We’re merely said that it had become overbought…and thus it should not be chased. (We also said that short-term traders should take a few chips off the table…but that they should still keep a considerable position in the group.) We did this in March of 2021…and then again last fall. Those calls also worked out quite well.

We’re starting to see the same kind of signs again right now. We might be a bit early with this call…so the group could still see some more upside movement as we move into the month of June. However, when you look at the weekly RSI charts and the weekly Bollinger Bands charts on the XLE and the XOP, you can see that they’re becoming extended on a technical basis……In fact, they’re both getting quite extended on their monthly RSI chart as well! (So it’s not out of the question that the next decline could be important.)

We believe that the fundamental backdrop for the energy sector remains excellent, but there are some potential political issues that could create some problems as well as we move thorough the summer (and towards the mid-term elections in November). Therefore, it looks like we’re heading into another period where investors should be a little bit more careful with the energy sector. This is a very similar situation to the other times when we’ve become a little less bullish on the group. In other words, we’re not saying that investors should sell the group. We just think that they should consider a more careful approach until the group has worked off these technical conditions. These conditions might be worked off with a “sideways” correction…so this is another reason why we’re not saying that this is a good time to take long-term profits. However, shorter-term traders might want to take a few chips off the table for a little while…while keeping many core positions.

Finally, we’d just like to mention that we’ll be looking at the political situation very closely over the summer. There will be a lot of pressure on President Biden to push energy prices back down to any degree that he can…and there could be some legislation (like a windfall profit tax) to make him look like he’s fighting for the average American during this midterm election season. We’ll also be looking for any signals that Russia will be able to delivery more oil and gas this fall and winter than is being projected at this time. Right now, we still believe that energy prices will hold up…and that the energy sector will continue to act well on a longer-term basis. However, we don’t want to be overly aggressive on the buyside on a short-term basis.

6) We’re headed for a recession…if one has not already begun. We have been saying this for months now. Of course, the vast majority of Wall Street is saying that a recession “is not their base case,” but that they do admit that the odds have grown. Well, those people will not call for a recession until we’re already in one (or even after it is over)……..Earnings forecasts are going to come down (in a big way) and the economy is going to fall into recession. This is what we all have to prepare for right now.

It’s kind of ridiculous how the vast majority of Wall Street goes through the motions of saying that they don’t expect a recession…even when one is staring them right in the face. It happens every time. People from both sides of the Street will either say that a recession is “not our base case”…or that it “won’t come this year”…in order to cover their asses. However, they know it’s coming.

Let’s face it, we’re not talking rocket science here. Ours is a consumer-based economy. With food and energy prices 70%+ higher from this time last year, that leaves a lot less money for discretionary items. The University of Michigan Consumer Confidence data on Friday fell to a new multi-year lows (the lowest in 11 years), so it does not look like things are going to improve any time soon. Credit card debt has begun to rise again. (As the NY Fed states, Americans are putting more on their credit cards to “cover the higher cost of everyday living.”) The yield curve has flattened significantly over the last year…subprime auto loan delinquencies are rising….tech companies are announcing layoffs and hiring freezes…home sales are falling…real income has fallen 7 out of the past 8 months…China is still in lockdown…and the stock market has fallen in a significant manner. (In many ways, the stock market has become the economy…every since

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member